Revenue cycle management doesn’t start with a claim, it starts the moment a patient begins the intake process. Yet patient intake is often treated as an administrative task instead of what it really is: the first and most critical opportunity to capture clear data, verify insurance, and set financial expectations. When done manually or inconsistently, intake leads to preventable denials, delayed reimbursements, and frustrated patients and staff alike.

In fact, a HFMA survey of over 350 revenue cycle leaders found that errors in patient registration were the top cause of initial claim denials. That makes intake, not billing, the real front line of revenue integrity.

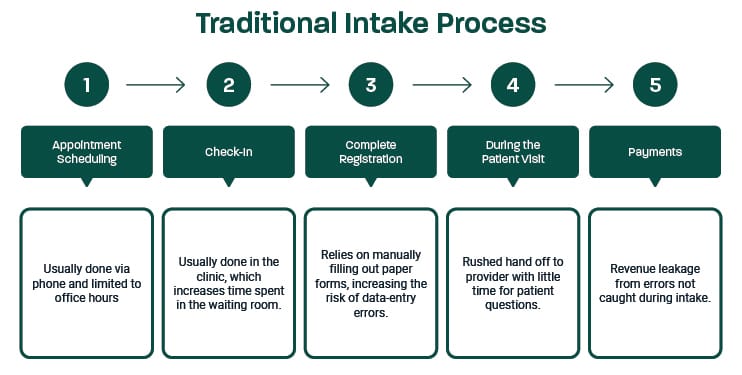

Many healthcare organizations still rely on a traditional intake workflow like the one below. While it may appear routine, it’s filled with hidden inefficiencies that erode revenue from day one.

Frequently Asked Questions: Intake’s Role in Revenue Cycle Performance

Even though intake is foundational to clean claims and faster payments, it’s often overlooked in revenue strategy conversations. The FAQs below answer key questions healthcare leaders are asking as they reexamine intake workflows to reduce denials, improve financial clearance, and ease front-office strain.

1. How can front-end automation improve revenue cycle performance?

Front-end automation turns intake into a reliable, revenue-protecting workflow. It eliminates the delays and data issues that often begin at registration where small errors can snowball into denied claims and delayed payments.

With digital intake and automation, healthcare organizations gain:

- Verifying insurance in real time at scheduling or check-in.

- Reducing errors from manual entry and incomplete forms.

- Syncing patient data directly to EHR and billing systems.

- Freeing staff from paperwork and follow-up tasks.

Organizations that automate intake have cut eligibility-related denials by up to 50%, while also speeding up billing and easing staff workload.

2. What are best practices for reducing eligibility-related denials?

Eligibility issues are one of the most common and preventable causes of claim denials. Improving this part of the intake process can have an immediate financial impact, especially when automation is involved.

Best practices include:

- Verifying insurance coverage in real time during pre-visit check-in.

- Flagging incomplete or invalid insurance information before claims are submitted.

- Allowing patients to upload insurance cards digitally for accuracy.

- Standardizing intake workflows to ensure insurance is always verified.

These steps reduce rework, ease staff burden, and improve overall revenue cycle reliability before a claim is ever submitted.

3. How do mobile check-ins improve clinic throughput?

Mobile check-ins allow patients to complete intake tasks like forms, insurance uploads, and consent signatures on their own time, before they arrive. This removes the bottleneck of in-person paperwork and reduces workload on front-desk staff.

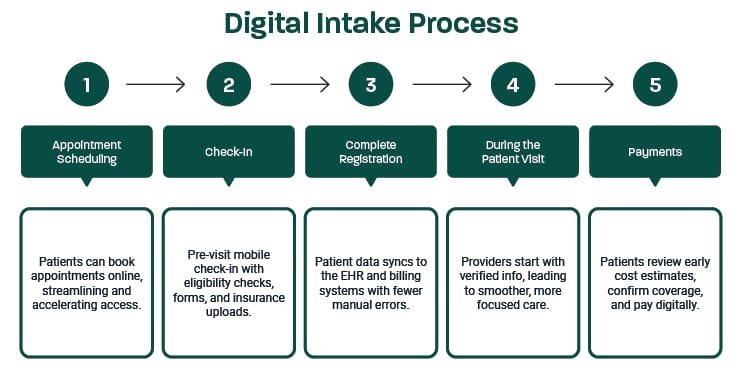

By eliminating manual data entry and streamlining the day-of-visit flow, mobile check-ins help clinics stay on schedule and increase the number of patients seen per day without adding headcount. Here’s what a modern digital intake workflow looks like in action, streamlined, patient-friendly, and built to support clinic throughput and revenue performance.

4. What role does visit cost transparency play in collections?

Cost transparency is one of the most effective ways to improve patient collections, and digital intake makes it easier to implement at scale. When patients know what they owe ahead of time, they’re more likely to pay at or before the point of service.

Here’s how cost transparency during intake supports collections:

- Sets financial expectations early in the patient journey.

- Reduces surprise billing and downstream disputes.

- Encourages payment at check-in or pre-visit.

- Minimizes the need for staff follow-up and collections outreach.

- Build trust by making financial conversations more proactive and predictable.

By embedding pre-visit estimates and co-payment collections into the check-in process, organizations can improve collection rates while also delivering a better patient experience.

5. How can intake data feed clean claims and faster billing?

Intake is the foundation of clean claims. When patient information is incomplete or inaccurate at intake, billing teams must spend time fixing errors, chasing documentation, or resubmitting claims, all of which delay reimbursement and add costs.

Digital intake captures structured, validated data and syncs directly into EHR and billing systems while ensuring required fields and consents are completed before the visit. This minimizes common administrative errors at their source.

Industry averages show that nearly 20% of claims are denied initially, and about 60% of those are never resubmitted, representing a huge, preventable revenue loss. By preventing these denials at intake, organizations improve clean claim rates, reduce billing rework, and accelerate payment times.

Why Intake Matters to Your Bottom Line

Revenue cycle success doesn’t start with billing. It starts with digital registration. The decisions made at this first step impact everything that follows, like claim accuracy, reimbursement speed, staff productivity, and patient satisfaction. When intake is fragmented or too manual, those downstream issues multiply. But when it’s digital, automated, and integrated, it becomes a powerful engine for operational and financial performance.

The most effective revenue cycle strategies aren’t reactive. They start at the front (desk).

Improve Access and Enhance Care with Relatient

Relatient is a healthcare technology leader dedicated to improving patient access through intelligent, mobile-first solutions. Our Best in KLAS platform Dash® integrates with leading EHRs and PM systems to streamline scheduling, personalized communication, online chat, mobile payments, and digital intake. Trusted by over 47,000 providers and managing approximately 150 million appointments annually, Relatient helps healthcare organizations optimize workflows, reduce no-shows, and enhance the patient experience with modern, consumer-driven solutions.